www.aljazeerah.info

Opinion Editorials, November 2012

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

US Fiscal Cliff:

No More than Juggling with Tax Expenditures

By Henry D'Souza

Chairman of the Federal Reserve Ben Bernanke coined the term “fiscal cliff” in 2012 and Robert Rubin, 1 who served under Clinton’s two Administrations as Secretary of State, and was a Wall Street man explained that “fiscal cliff” referred to spending cuts and tax hikes that are being discussed in accordance with the Simpson-Bowles formula. The bi-partisan Simpson-Bowles committee2 on finance recommended that the ratio should be at least $ 2.00 of spending cuts for every $ 1.00 of revenue increase.

However, Bernanke’s should have used “cliff” earlier, in 2008, when President Obama encountered a collapse of the banking sector, Wall Street, a housing crisis, and the demise of the motor industry, an American flagship. Bernanke and Obama’s Treasury Secretary Timothy Geithner solved this unprecedented crisis by printing money, so that in each of the last four years the deficit exceeded $1 trillion. The Treasury pumped money into the economy three times, with Quantitative Easing (QE) 1, QE 2, and QE 3.

Deficits ($) Under

Bush

Obama

FY 2009: 1,413 b

2013: 901 b

2008: 459 b

2012: 1,089 b

2007: 161 b

2011: 1,300 b

2010: 1,293 b

Source: Christopher Chantrill, “Limit to annual

deficits in US,” usgovernmentspending.com

Official figures on federal deficits are deceptive when the Bush2 deficits are compared with Obama’s; the former fought unfunded wars so that expenditures on wars are not in the budget, while Obama insisted on transparency in the accounting system, though his too was limited.

Some critics suggest that “cliff” is not the best word since the effects of belt-tightening will be felt gradually. “Fiscal slope” would be a better title. ABC News seems fixated on taxes hence, “taxmageddon” for fiscal cliff.3 Whatever the interpretation, “cliff” suggests that the situation is desperate and the Fed can no longer print money. “The stakes are high” warns Bernanke.

Masters4 suggests that the recent era starts with Bush-era tax cuts, post 9/11 spending on wars, TARP bailouts, the Recovery Act, new entitlements, new policies pursued during the financial crisis and the subsequent downturn.

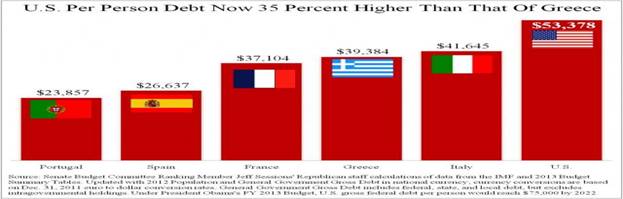

During this era, Americans in all walks of life have been spending as if there were no tomorrow. One indication is the rise of the national debt.

The Congress-set national debt ceiling of $14.295 trillion was reached on May 16, 2012. With juggling, the nation could manage within this target until August 2. The ceiling is currently at $16.2 trillion: public-held debt was $11.35 trillion and intra-governmental debt was $4.85 trillion. Majority leader in the Senate Harry Reid wants the ceiling to be raised to $18 trillion, a sign of desperation. Since 1962, the ceiling has been raised 74 times. Treasury Secretary Timothy Geithner suggests the elimination of a ceiling - a dangerous and unacceptable idea.

5To pay for this debt, the US has to borrow from

financial institutions and nations that have excess cash.

Foreign governments hold $4.4 trillion worth of debt in the form

of financial instruments. China is the largest foreign creditor

($1.16tr). Next comes Japan ($1.11tr), oil producing countries hold $261

billion, and Brazil, fourth largest, holds $242 billion.6

Some sectors, like the Pentagon, do not think that borrowing is

a disadvantage, while others feel that it is gross liability.

Pollock7 warns us that a “substantial

amount of federal borrowing is not counted in the budget, like Agency

Debt. Examples of such debt

include Fannie Mae, Freddie Mac, and other off-budget agencies, which

rely on US debt. All this debt influences interest rates for these

securities.

Every annual deficit adds to the national debt.

The annual deficit of $1.1 trillion is unsustainable.

The fiscal cliff seeks to reduce the deficit to $641b from $1.1

trillion in 2012, a decline of $487 b.

A reduction of the national debt is laudable, but this amount is

not enough.

In addition, almost all states are bankrupt and

find difficulty in paying the extended unemployment benefits that Obama

legislated. These “shadow

bailouts” for just 32 states amount to $37.8 billion: California ($6.9

b), Michigan ($ 3.9 b), and New York ($ 3.2 b) are the largest three

that needed help.8

Households also carry a lot of debt.

By July 2012, household debt amounted to $11.28 trillion, while

the delinquency rate was 9%.

The breakdown is as follows: mortgages: $463 b; student loans,

$914 b; and, credit cards and consumer credit balances equaled $672 b.9

National debt, annual deficits, bankruptcies of

all 50 states, and household debt all lead Bernanke to claim that the

“stakes are high.”

Mediation between the two parties has to be a priority.

Gridlock, as in the previous four years, is not in the nation’s

interest.

The US needs savings of $ 2 trillion annually so

that the national debt can be halved by the end of the Obama era.

Half of it should come from the military and the other half from

tax revenues and spending cuts. This target may seem impossible but it

is achievable even though it might lead to a depression in the short

run. The very thought that

the US has this target in mind will restore confidence in the global

finance markets. Obviously

those laid off should have some kind of security net.

Let us examine what solutions have been proposed.

Should Congress not come up with a solution by the end of December 2012, the fiscal cliff measures will operate from January 2013, so as to yield at least $607 b. The non-partisan Tax Policy Centre also notes that on average each household will pay $3,400 extra per year.10

Xtra tax breakdown

Average Income:

xtra tax

Average Income: xtra tax

Average Income: Xtra tax

$11, 239:$ 412

29, 204: 1,231

49, 842: 1,984

80, 080: 3,540

178,020: 14,173

1.3million: 120,537

Source: Rick Newman

Secretary of Defense Leon Edward Panetta proposed a defense budget cut of $487 billion or 8% from planned defense spending over a decade. He suggested that the fiscal cliff, or Sequestration, would add $492 b.

Retired Army Lieutenant General David Barno would add about $200b to Panetta’s proposal by a policy of Constrained Global Presence. A Stimson Center Defense panel would go further by adding $500 b to Panetta’s figures “with acceptable level of risks.” These adjustments show that the Pentagon could yield at least $1 trillion annually for the next decade.

Two facts should be remembered at this point. The first is that the US military budget is 40% of worldwide expenditure on the military or equals the expenditure for the next 14 top expenditures, and most of them are US allies. This exorbitant expenditure shows that the defense budget needs to go through a juice extractor.

The second fact is that the military budget is hidden in different Departments, so that Pentagon’s figures are most likely deflated. Nuclear weapons come under the Department of Energy, the drone franchise is under the CIA budget, satellites are under NASA, benefits come under Veteran Affairs, and so on.11

These two facts show that Obama can obtain a lot of juice from the military. He would, of course, be accused of being a coward, a communist, a socialist and a stingy born-again un-American President of the USA.

For the next 4 years, the budget should be balanced annually, with 10% going into a fund, so that any borrowing should only equal what is in this fund, and that too in exceptional circumstances. Obviously other measures are needed to combat a recession. One has to agree with Alex Seitz-wald that Grover Norquist’s anti-tax Republican lobby will be in decline in today’s fiscal crisis.12

As Rubin pointed out the “tax expenditure goose doesn’t have enough golden eggs.” Fiscal cliff, as used by Americans, is basically about juggling with tax expenditures, but this is not enough. A drastic short-term remedy to halve the national debt is needed so as to squeeze $2 trillion annually from the economy for the next four years. This is a more cavalier approach than the one Obama is taking.

There is one important change that should be in the works. Obama was elected by grassroots supporters, who should be recruited to participate in government. Paid local officials should involve locals to make suggestions to the Democratic Party about the major problems of the day. This is just one way that the President would have his ear to the ground.

November 30, 2012

© Henry D’ Souza, #601-3700 Kaneff

Crescent, Mississauga, ON, L5A 4B8

Images will be deleted when

commercialized

Criticism welcome

IMAGES

T. Geithner

Robert Rubin

Cartoon by chinadaily.com

Leon Panetta Grover Norquist

Presented by Karen Dynan, V-P & Co-director

Economic Studies, brookings.edu, September 6, 2012.

|

|

|

|

||

|

||||||