www.aljazeerah.info

Opinion Editorials, April 2012

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

The 2012 Euro Crisis

By Noela D'Souza

Al-Jazeerah, CCUN, April 16, 2012

The European

Union (EU) had agreed to the Stability for Growth Pact, which stipulated

that each country should operate with 3% of GDP or less of debt, and/or a

debt/GDP ratio of less than 60%.1

By 2012, the EU was in a recession, which was defined as two

consecutive quarters of negative growth.

In 2010

most countries, starting with Germany, seemed to have gone beyond the

agreed rates:

Scandinavian, and a few East European countries,

seemed to stick to the guidelines.

Austria has been exemplary in controlling its budget.

The three large powers of the EU, Germany, France, and Britain,

could export themselves out of a crisis.

But the PIIGS, Portugal, Ireland, Italy, Greece and Spain needed

bailouts.

Markit’s

purchasing managers index for the EU, which measures business activity,

fell to a three month low of 47.7% in March 2012.

A figure below 50 indicates contraction.3

Any

recession has social consequences and high unemployment rates are an

indication of trouble. The

2012 unemployment rate for the 27 countries in the EU was 10.2%, or 24.55

million jobless, while in the 17 Eurozone countries it was 10.8%, or 17.1

million unemployed. The

relevant unemployment statistics for the PIIGS was extremely troubling:

Portugal, for example, 35.4%, Italy 31.9%, and Spain 23.6%.

The unemployment rate among youth in Spain and Greece was almost

50%.4

However

the future seems bright, if the reputable Standard and Poor’s (S&P’s)

prediction is correct. S & P

feels that the EU will pull out of a recession by the end of the year.5

Several

issues arise from these facts: what are the causes of the Eurozone crisis?

How did each country handle their problems? Is Europe following the US or

is it the other way round? Potential Republican leader Mitt Romney

suggests that his rival President Barack Obama is following Europe with

socialist policies, like Obamacare. If the globe is interdependent, what

are the consequences outside the two Superpowers, USA and EU?

Starting

with the 1970s, doctrinaire neo-con leaders seemed to be propagating the

doctrine that markets would correct themselves; theirs was unadulterated

laissez faire.

The most prominent advocate of this theory was Fed chairman Alan

Greenspan. When the Eurozone

crisis proved the conservatives wrong, Greenspan declared openly that he

was wrong.

Regulation was anathema to these conservatives. With

derivatives, banks transferred the onus of bankruptcy by borrowers to

others. Cheap money therefore

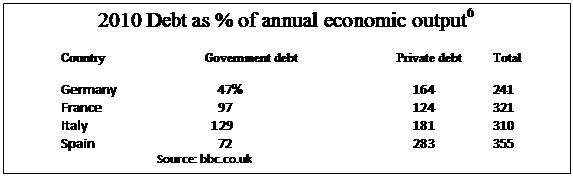

led to increasing debt and a bubble. By 2010 government and private debt

of the larger euro partners as a percentage of annual economic output was

extremely high. (See table above.)

Greece was

the worst hit. About $130

billion/€ 100 billion Greek bonds were held under Greek law, and thus

saved the government from bankruptcy, as Greece could re-negotiate the

terms. Another $26.8 billion

of bonds were held under foreign law and Greece needed a debt exchange

with adjusted payment dates.7 Unemployment in Greece was 20%.

Greece seemed to be on the verge of losing its sovereignty as its budget

would have to be supervised by the EU, Germany in particular, since it

wrote the biggest cheques.

A 77-year old pensioner-pharmacist who shot himself in

front of parliament rather than scavenge for food showed the dire straits

that Greece was in. The

public held him as a “martyr for Greece,”8 which has to undergo

a painful lowering of its standard of living.

The Prime

Minister of Luxembourg Jean-Claude Juncker felt that there was an

international conspiracy to destroy the euro.

It may have seemed so, but the EU had to take responsibility for

overspending. The Swedish

Finance Minister seemed more credible when he said that wicked speculators

were behaving like “wolf-packs.”9

These remarks underlined a tussle between creditors and debtors.

Germany

felt that debtors were ungrateful and was reluctant to help.

The accusation that Germany wanted to destroy Greece as it did

during the Second World War seemed far-fetched.

Another reason for the euro crisis is that change

comes slowly when acceptance is needed of 17 countries in case of the

Eurozone and 27 in the case of the EU.

A case in point is the late introduction of fiscal policies for

bailouts by the European Central Bank. The ideal would have been for

planners to anticipate change, be ahead of the curve, after some sound

research. The Med club is

poor at the moment, but given time, industry is likely to shift to the

coastal areas, as it did in the US. The southern EU states must attract

capital for this move to take place.

In the US relatively cheap labor is currently attracting motor

firms to the South.

Lastly,

the EU and its ally the US are facing severe competition from the BRICS,

Brazil, Russia, India, China and South Africa.

The 5-nation BRICS account for 20% of the world’s economy,

amounting to $13.5 trillion.

By the 2012 Delhi Declaration, the BRICS want their currencies to replace,

wherever possible, the dollar and the euro, thus reducing transaction

costs.10

The BRICS

The Eurozone crisis placed the EU in an awkward

situation. Should the

Eurozone be dismantled? Should Greece, the worst culprit, be expelled?

If that were done what would happen when others defaulted? Should

the 27 countries assist the 17 or 16 in the Eurozone?

Germany, with the strongest economy, was reluctant to support a

huge bailout, especially since it experienced hyperinflation during the

Weimar Republic. But as

Germany benefitted from the Eurozone through its exports and lending

ability, it had to act responsibly.

Eventually, after much thought, it was decided to keep the Eurozone

intact. The EU decided that its Central Bank should have $1 trillion as a

firewall, “the mother of all firewalls,” head of the Organization for

Economic Cooperation and Development Angel Gurria declared.11

The head of the IMF Christine Legarde asked EU countries to add

another $500 billion in case of additional need – a double firewall.12

Some argue that the firewall should be an impressive $2 trillion.

A first

tranche of €300 billion was already pledged for the PIIGS.

In March 2012, a decision was made for the European Financial

Stability Facility (EFSF) to raise the new funds from €500 billion to €750

billion. A second

institution, the European Stability Mechanism (ESM) is expected to play a

bigger part, and eventually take over the functions of EFSF.13

Germany eventually pledged €184 billion for the €750 billion

tranche.14

While Germany wanted to have money and budget discipline measures, France

wanted open-ended loan guarantees, perhaps because it may be one of the

countries needing bailouts in the near future.

Reporter

Matthew Lynn is worried about France owing to the rise of the extreme

right Le Pen conservatives who are against the euro; in 2010, its debt was

the 5th largest in the Eurozone and rising; it is reluctant to

change and is less competitive than Germany.15

Britain

has been in a recession since the third quarter of

2010. Its unemployment rate

is 8.3% for adults and intolerably high at 21.9% for youths below 24 years

of age.16 In

addition it is faced with high inflation owing partly to high oil costs.

But its Markit index is 2.9 percentage points above 50.

Since 2009/10, it has been injecting money into the economy: its

QE1 was £200 billion; its QE2 is £75 billion and is likely to rise to £500

billion in stages.17 Though

Britain is not out of the woods yet, a tightening of its budget has

allowed it to thrive on lower interest rates than those of the PIIGS.

Spain was

required to bring its budget deficit to 4.2% but it could not; its target

this year is 5.9% but it promises to make up the following year by

budgeting for 3%, said Spanish Premier Mariano Rajoy.18

The IMF

declared that Portugal’s budget of 3.2% was praiseworthy and offered it a

loan of €5.17 billion.

Portugal is trying to comply with Eurozone’s restrictions.19

The euro

crisis showed that the EU failed to recognize that it is in a

post-imperial era and trickle-down economics may work for the rich, but it

takes time for benefits to percolate to low level workers, and the latter

are not prepared to wait.

The

relatively successful management of the economy by Austria in Europe, and

Canada in North America, also showed that timely adjustments have to be

made to synchronize with the vicissitudes of the market.

Obviously borrowing can be good, but there are limits to how much

can, or should be, borrowed.

Another

lesson that can be learnt is that drastic cuts to the economy can lead to

a depression and social strife, so that provisions in a budget have to be

made to allow for growth and a tolerable unemployment rate.

A larger

question needs to be addressed: is the US being Europeanized or is it the

other way round? Mitt Romney

felt that Obama’s fiscal and monetary policies were making the US look

more like Socialist Europe.

This view was backed by Fellow of Economic Studies Douglas Elliott who

suggested that 2012 might be the year when the US imports a recession from

Europe.20

Evidence

shows that, for better or worse, the US still leads Europe, shamefully, as

it shows that Europeans cannot think and act for themselves. Finnish

Minister for European Affairs and Foreign Trade Alexander Stubb noted that

the European financial hysteria started in September 2008, 21

when the US started theirs.

The various stages of Quantitative Easing (QE) in the US are now being

adopted by Europe. What QE

means in practice is that the European Central Bank (ECB), like the

Federal Reserve in the US, should print as much money as is needed to

overcome the crisis; in good times, the huge debt can be redeemed,

hopefully. Treasury Secretary

Timothy Geithner’s formula is “Do what it takes.”

Since

European banks were reluctant to lend to each other, as in the US, the ECB

had to make cheap loans available to the banks to encourage them to lend,

again as in the US. In simple

language, the ECB had to print money without adequate collateral, as in

the US.

There were

other institutions that supplemented ECB effort: ESFS, IMF, and the US,

except that this time the help that the US usually gave readily was

non-existent. The US is the

world’s largest debtor nation.

China has also been a willing donor to the EU, when asked.

An expert on monetary affairs Domenico Lombardi thought that the

ECB could tap the IMF, since the EU holds 23% of the Special Drawing

Rights (SDRs) capital base.22

Elliott

suggests that the US should pay more attention to Europe than it does for

the sake of self-interest: the US exports $400 billion annually to the EU;

the US has over $1trillion of investments in Europe.

The US has $5 trillion of credit exposure in Europe.23

Financial expert Rana Faroohar adds that Washington needs to pay

attention as 80% of Europe’s debt is held by EU banks and the latter hold

$55 trillion in assets, four times that held by US banks.

The Eurozone contributes to 20% of the global economy and if the

Euro fails, the US is bound to be affected.24

At least one reporter provided evidence that the US Treasury played

an important role in the European crisis.

Chakrabortty25 noted that the International Institute

for Finance (IIF), a lobby group of 450 of the largest bankers in the

world, arranged the package for Greece.

Charles Dallare a Treasury official during Ronald Reagan’s

Administration and Josef Ackermann, chief executive of Deutche Bank played

a “catalytic” role in this deal.

Dallare, probably backed by Wall Street, was behind Greece’s

“comprehensive package.” Chakrabortty reported that the IIF admitted to

negotiating with various governments on a range of issues to save Greece.

The US is obviously influencing Europe directly or

indirectly. However, if the

Supreme Court allows Obamacare to function as it should, then the US would

look more like Socialist Europe.

It should be mentioned that most countries, even developing ones,

try to implement universal healthcare, while American insurance companies

are trying to place obstacles to their healthcare system through

objections to the universal mandate and projections of escalating costs to

the Treasury. The Supreme

Court will decide in summer whether the charges against Obamacare violate

the constitution.

The Euro crisis affects not only the EU but also the

rest of the world indirectly.

Take one example in foreign policy.

The US and the Republic of China (Taiwan) signed a defense treaty

in late 1954 which was meant to contain Communist China.

With the latter being the US’s largest creditor and the inevitable

desire of the US to befriend China, it is difficult to see how the US can

implement this treaty.

References

1.

Satyajit Das, “Without

wings, sans prayers,” smh.com.au, November 3, 2011.

2.

Ibid.

3.

AP, “Eurozone jobless

rate hits record 10.8%,” cbc.ca, April 2, 2012.

4.

Ibid.

5.

“S & P: Europe should

pull out of recession in late 2012,” economictimes.indiatimes.com, April

4, 2012.

6.

“What really caused the

Eurozone crisis?” bbc.co.uk, 22.12.2011.

7.

Landon Thomas, “Greece

is in a face-off with its bondholders,” iht.com, April 3, 2012.

8.

Rene Maltezon, “Greek

pensioner who killed himself over austerity measures ‘a martyr.’” Reuters,

April 6, 2012.

9.

Charlemagne, “Europe’s

750b euro bazooka,” economist.com, May 10, 2010.

10.

Wujiao & Fu Jing, “The

fourth BRICS summit,” chinadaily.com.cn.

11.

Andrew Alexander,

“Beware of Spanish practices when a new deal is signed,” the

olivepress.es, March 12, 2012.

12.

Economictimes.com, April

1, 2012.

13.

Francesca Landini &

Robin Emmett, “EU clears $1 trillion firewall,” khaleejtimes.com, March

31, 2012.

14.

Marko Papic et al,

“Europe’s Gordon knot,” atimes.com, May 21, 2010 has $123 billion, less

than this figure.

15.

Matthew Lynn, “Leave la

France: it’s the next danger zone in the bondholders’ euro tour,”

smh.com.au, May 7, 2011.

16.

Norma Cohen & Sarah

O’Connor, “UK recession deeper than first thought;”

17.

Larry Elliott & Katie

Allen, “Britain in grip of worst financial crisis, Bank of England

Governor fears,” guardian.co.uk, October 6, 2011.

18.

Andrew Alexander op.cit.

19.

“IMF approves €5.17

billion euro loan to Portugal,” hindustantimes.com, April 5, 2012.

20.

Douglas Elliott, “2012:

The year we import recession from Europe?” brookings.edu, December 20,

2011.

21.

Alexander Stubb, “Will

Europe Survive Crisis?” brookings.edu, March 12, 2012.

22.

Domenico Lombardi, “The

IMF and Eurozone: Weighing unconventional options to stabilize the global

economy,” brookings.ed.

23.

Douglas Elliott, op.

cit.

24.

Rana Faroohar, “Why Care

about the euro? Time, November 7, 2011, 20.

25.

Aditya Chakrabortty,

“Why do bankers get to decide who pays for the mess Europe is in?”

guardian.co.uk, April 2, 2012.

The Eurozone countries

Symbol of the euro

Timothy

Geithner

|

|

|

|

||

|

||||||